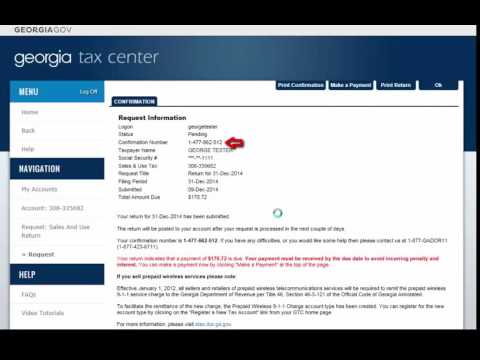

Welcome to the Georgia Department of Revenue Georgia Tax Center instructional videos. This video will cover how to file a simple sales tax return. To begin, log into GTC at this address. Fields that are required must be completed before continuing. Entries that are in error display a red triangle in the upper left corner of the field. Correct these fields to continue. Enter your username and password, then click on "login". Click on your sales tax account ID, then click on "file return" for the period you want to file. Step one: to determine the form you choose, if no, a $0 return will be created for you to submit. So we choose "yes" for this demonstration. Please make sure you choose the correct period and click "OK". Step two: choose the county from the drop-down. The st three short form allows for only a single county selection. After entering the amount, click "OK", then click "Submit" and click on "yes" to confirm the request. You will see the confirmation page. Please note the confirmation number or print the page for your records. At this point, you can finish by clicking on "OK", or if you want to make a payment, choose "make a payment". Enter the date when you want the payment to be debited from your bank account. Then choose the bank account type and enter the routing number and account number. Re-enter the account number to confirm. Select the link in the voucher, your account information will be saved and you will not have to type this in again when making payments. After filling the bank information, click "Submit", then click "yes" to confirm the request. Print this page or write down your confirmation number for your records. This number is for your payment. After this,...

Award-winning PDF software

Georgia wg15 Form: What You Should Know

Selecting the state employment form to receive withholding and tax deductions from the check. Clicking the button above each area to select which area you have selected for filling out. When selected, each box of the form will be checked for the information that you entered. You may use a blank form to start by and leave all other fields blank as you fill out the form. If you have any other questions concerning the filling-out of our employment forms, please feel free to call us toll-free at or fax us at. What is State Employment Form? Form (S1) is to be filled out and submitted to your employer in order to have tax withheld from your wages. Form has 16 areas or tabs to select from. Form is very easy to complete with our easy to fill out fillable templates. Form (S1) in English | Spanish | Fax Fill In the Department of Labor Employment Wage Inquiry form we 15. Select the areas from the table below and select the corresponding area number of Form S1. Click the link below to view our fillable template that matches your area number and your information, or simply download the PDF from here and fill out by hand: Fill in the Department of Labor Employment wage inquiry form we 15. What is the Georgia Employment Form? Filling-Out the Department of Labor Form we 15. The form has 16 areas or regions. Fill In the Department of Labor Employment Wage Inquiry form we 15. The forms have 16 areas or tabs to select from. What are our fillable templates? This fillable template will help you fill out the form with the easiest and most efficient methods. You will start with the table below which is used to select an area and to the end of the page where you then find the area codes. The fillable templates are in PDF format; you have to download it first.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ga Dol-4N, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ga Dol-4N online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ga Dol-4N by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ga Dol-4N from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Georgia form wg15